New School Protesters: Your Occupation of Fail is Complete

Can anyone tell me, coherently, what those kids at the New School are even protesting?

Can anyone tell me, coherently, what those kids at the New School are even protesting?

If these kids were smart, they'd have a website up. They'd optimize it for search and maybe even buy some keywords to advertise against "New School" searches. The ads should say "Why we protested" or something like that... and the site would have a well-written, neatly laid out list of demands.

Instead, after searching around a fair bit, I can't find anything substantive about their plea. I don't know how I'm suppose to sympathize with their cause if I don't even know what their cause is.

They don't like the way the school is run...or something that?

Huh?

Apparently, the faculty isn't a fan of the way the school is run either--particularly Bob Kerrey's attempts to run the school like an economically viable business.

God forbid.

Let's get one thing straight. The costs of education are spiraling out of control--and do you know why? It's in big part because you've got PhD faculty getting paid 100k a year to teach one class a semester--using the same syllabus they've been using for 20 years--and to publish research in academic journals that maybe 10 other academics ever read.

Do you think the average tenured college professor works half as hard as the average NYC public high school or elementary school teacher--who is by the way making less than half the pay? When 95% of university faculty vote against something--I have to question what could all universally make them so upset. Yup... do more work for the same amount of pay ought to get everyone up in arms. As an adjunct making $4,000 for the one class I teach each semester, I can't say I have a lot of sympathy for them.

Let's pretend this school was a company. Could you imagine shareholders or employees trying to affect change the way these students were acting? Do me a favor. If you support these kids, the next time you have a problem with your boss, break into his office and "occupy" it. When security comes to usher you out, scream like a lunatic.

See how far that gets you.

And as for police brutality, I watched the videos. I saw a metal barrier being hurled at police, lots of screaming, and one kid get knocked down by a cop. That kid proceeded to scream and resist arrest while cops yelled "Stop resisting!"

When are people going to realize that when you throw metal things at cops and resist arrest, you might get a bit jostled during the arrest process? Thus far, in my 29 years of living in NYC, I've been able to avoid getting beat up by NYC police. There's a trick to it: Don't throw metal things at cops and resist arrest. I know, I know, it seems difficult, but you have to try.

You know who was even angrier than those protesting kids? The kids who are paying tuition who actually wanted to come in on those days and use those buildings to study.

Here's the way to affect change: If you don't like the way your school is run, you could...

1) Transfer.

2) Run for student leadership positions and try to get rules enacted or changed by working together with the administration.

3) Expose the issues you have with the school to local media, donors, trustees, etc...with a good old fashioned PR campaign.

Or, if you'd rather look like a bunch of spoiled rich kids who think they know better than everyone else:

1) Unlawfully commit breaking and entering, carrying mace and crowbars into school buildings.

2) Create a public disturbance that puts the general public in harm's way (you know, b/c most people's noggins don't mix well with hurled metal barricades).

3) Completely fail to get any kind of coherent message across.

At the end of the day, I don't know if Bob Kerrey is good for that school or not--and that's kind of the problem. By completely failing to make any kind of articulate case against him, these protesters utterly fail to draw any sympathy to their cause. I put them in the same bucket as the people who spit on US soldiers returning home from Vietnam--so crazed over the idea of protest that they fail to identify any kind of logical and reasonable means to promote their ideas.

My recent tracks on Last.fm

The most recent tracks I've been listening to on last.fm:

Thoughts on the 2010 Taurus

So here's the first thing that jumps out at you about the new Taurus--It doesn't look like a Taurus. That's probably a good thing in this case, especially in the back. I never liked the back of the Taurus either in the mid 90's or the more recent, less boxy back. This back is like a better version of one of the recent takes on the Mercury Cougar. Still, with my Mustang, it's clear that it's a Mustang. With a Taurus, if it's constantly changing, will that hurt the brand recognition? What's a Taurus supposed to look like?

Live at Ford Taurus Roundtable Dinner to see the 2010

So the nice folks at Ford are paying for my meal, but actually, I realized after being invited that I have a history with this car. Not only am I a current Ford driver ('06 GT Conv), but the Ford Taurus was the first car I ever drove. It was back in 1995. I was almost but not quite 16. I had a family member in the hospital and my mom was pretty stressed out so I think I caught her at a weak moment. We were going down a quiet straightaway by Staten Island Hospital and I asked if she'd let me drive. I think she let me go two blocks before she freaked and told me to pull over.

Path 101 is hiring a developer: What we want out of both the person and the resume...and who we are.

Path 101, the company I started with our CTO and Co-Founder, Alex Lines, is looking to hire a developer.

Over and above anything else, here's the kind of person we want:

- Someone with a sense of ownership and pride in their work. We get that nothing can ever be perfect, but you need to constantly strive to make things better. This means not only making stuff works, but that it's easy to use and makes sense--and that you try to make it easier to use and more interesting everyday.

- You see the bigger picture--you realize that there are really exciting things to work on and then there's bug fixing--but at the end of the day you're happy we're moving forward as a team, as a company, and as a product.

- You really hate when stuff breaks or it sucks and it keeps you up at night.

- You're friendly and/or interesting and are just cool to hangout with--not too uptight to break for a snowball fight in the park or to randomly pass funny images to the rest of the team on chat.

As for the tech stuff, an intelligent, curious, ambitious person can learn anything, that's true, but ideally you'd be an intelligent, curious, ambitious person AND be as much of the following as possible:

- experienced web developer

- very strong understanding of python

- extensive experience with django - you know its strengths and

weaknesses, its ecosystem of libraries and components, participate in

django community <-- This is ideal, but if you're strong in python, let's chat. - obsessed with performance

- you can talk for hours about caching <--Alex's criteria, not mine. Don't talk to me about caching... ever.

- experience with mysql

- know how to properly normalize a data model as well as the costs and

benefits of denormalization - strong unix/linux background

- conversant in html/css/javascript

- familiarity with column-oriented / key-value stores is a plus

We'll accept a resume but prefer a link to your blog and linkedin profile.

Here are some things you might what to know about us:

- We're helping people figure out their careers. While this might not be feeding the poor, helping someone figure out what they want to do that makes them happy can really make a significant impact in someone's life.

- We're doing it in an innovative way--by crawling the web for resumes and laying on interesting user data, like personality, blogs, tags, anything you want to tell us about yourself--in order to figure out what everyone's really doing with their careers. This way, we can help you put your career in a context and figure out what "people like me" do for a living. There are around 10 million resumes out there and we're going to crawl every last one of them.

- We're funded by some seriously smart and successful angels like Roger Ehrenberg, Fred Wilson, Brad Burnham, Scott Heiferman, Jeff Jarvis, Hunter Walk, Jeff Stewart, Peter Hershberg, Joshua Stylman, Brian Harniman, Shripriya Mahesh, and others...

- We were the first company to ever get an investment by the recently launched NYC Seed fund.

- We're really passionate and dedicated to what we're doing.

- Team: Charlie (@ceonyc), Alex (@alexlines), and Hilary (@hmason), as well as some super awesome contract folks.

So, tweet @ us, e-mail us, or leave a comment. But please, no recruiters. We can't afford a recruiter, so there's really just no point to reaching out. We're really serious. Really. Serious.

EnergyHub: The coolest NYC company you've probably never heard of raises money

New York City based EnergyHub just received it's first round of venture financing, from Physic Ventures and .406 Ventures. News on the financing from NYC journalists: conspicuously absent. Wake up, folks! It was on VentureBeat last night!

That's exciting to me for a number of reasons. First of all, what they do is very cool. The company makes information systems that help you monitor your energy usage. This way, instead of a bill with just the bottom line of how many Kilowatt hours you used last month, you can get an in-depth view of how you're using energy. This is key to reducing peak consumption and lowering your costs. It would certainly be nice to know how much money and power my computer is costing me each day.

That's exciting to me for a number of reasons. First of all, what they do is very cool. The company makes information systems that help you monitor your energy usage. This way, instead of a bill with just the bottom line of how many Kilowatt hours you used last month, you can get an in-depth view of how you're using energy. This is key to reducing peak consumption and lowering your costs. It would certainly be nice to know how much money and power my computer is costing me each day.

What's very cool is that I got the opportunity to work with the founders, Seth and Tom, at ITAC's FastTrac class, where I am the Entrepreneur-in-Residence. (In this case, EIR is a fancy way of saying that I'm the class instructor and good utility guy to have close by to help startups working with ITAC). If you're interested in future FastTrac programs given by ITAC, you should contact Veronica Price at vprice@itac.org. There are a lot of programs, consultants and advisors for startups in NYC--

They come out of Honeybee Robotics, a New York-based company that builds hardware for NASA’s Mars missions and the Department of Defense. Who said everything in NYC was about finance, advertising and media? They're really awesome guys and I'm glad to see them get their funding. I can't wait to be able to buy an EnergyHub system for my apartment.

What's also great is that they got money from .406 Ventures--making this .406's 2nd investment in Brooklyn (they're also in Kaltura). I had the opportunity to talk to Larry Begley in the fall and he was super smart and extremely approachable. Hopefully, there will be more NYC-area based investing from .406 in the future.

BTW... Good thing Ted Williams choose to play that final day of the season. .39955 Ventures just doesn't have the same ring to it.

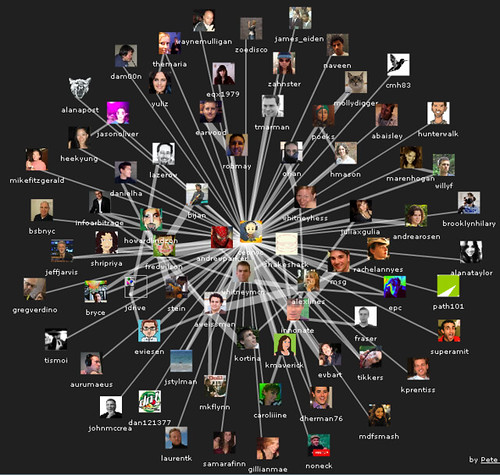

My Twitter BFFs

This is the network of people I interact with over Twitter... Interesting. I like how you can see the mini-networks within my network.

a lifetime burning in every moment

"It is, I think, that we are all so alone in what lies deepest in our souls, so unable to find the words, and perhaps the courage to speak with unlocked hearts, that we dont know at all that it is the same with others." Sheldon Vanauken, A Severe Mercy"

The speech the NAA should hear « BuzzMachine

"Your Google snits dont even address your far more profound problem: the vast majority of your potential audience who never come to your sites, the young people who will never read your newspapers. You all remember the quote from a college student in The New York Times a year ago, the one that has kept you up at night. Lets say it together: If the news is that important, it will find me. What are you doing to take your news to her? You still expect her to come to you - to your website or to the newsstand - just because of the magnetic pull of your old brand. But she wont, and you know it. You lost an entire generation. You lost the future of news. You blew it."

Capitalization aside, a really thoughtful comment from Jeremy on utility

utility is a powerful concept. imho, its the most important concept in economics.

at this point in my life, my main goal is to maximize my financial security. that doesn't mean i wont sacrifice my happiness. i wont take a higher paying job over a lower paying job if i like the latter better. however, i will always try to maximize finances. i live frugally. when i go out with my friends we go to $ drafts, etc. i plan on moving to a cheaper apartment when my lease is up in july. every penny i have right now is in the stock market. i almost live purely on credit. if at some point in the next year when the rental yield equation screams buy, i will probably put myself into some serious debt-- even if that means saving $500/mo. $500/mo goes a LONG way (think about compounded interest, etc).

at some level, im pretty emotionally detached. i don't look at financial losses and cringe. i like math and im as numbers oriented as they come. however, i live this way for a reason (granted the economy also sucks). my greatest fear in life is that i will not be able to provide the same quality of life for my family as my parents have provided for me. im extremely lucky. ive had a great life, realistically, i think ill probably make $7-10m in my lifetime. with a family, after taxes and living expenses im not quite sure where that leaves me. certainly that is more than enough for a great life and maybe leaves me 500k-$1m net worth to retire on.

thats my logic for living the way i do, right now. i need to save to reach that goal. however, i think that will change. if i reach my goals, i think i will probably want to own a home when the equation says rent. sure, there will be external factors that lead to this decision (maybe my wife kicks my ass and that pleases her as well). but for me, it symbolizes the fact that i can provide for others in the way i was provided for. i wont mind being tied down by financial assets, etc. i want my kids to play little league and go k-12 with the same friends as i did. why? because that made me happy and i want to give someone else that same opportunity. life is too short not to maximize your happiness. im willing to sacrifice myself when im young and hate life so to speak. ill *say* i hate life because ill work 18 hour days to get where i want to go. that might not be fun, but it still makes me happy based on my future utility potential.

so yeah, i think it holds true for BOTH groups-- our parents and us. of course, this is just me. i know many of my friends feel the same way but utility is a strange thing. utility is what got us into this mess (too many people tried to maximize what made them happy). utility is why markets aren't efficient (think greed and fear). people tend to act on emotion first. clearly my lifestyle is a result of my emotions. am i doing things the right way? im not sure. utility inhibits our ability to learn in the short term and this holds true for just about every results based environment. ultimately, learning comes down to luck. i guess ill have to wait and see.

Originally posted as a comment by jeremystein on This is going to be BIG! using Disqus.

Is the American Dream of home ownership all wrong for us?

The American Dream has always included buying a house. Saving up enough for a down payment on your own house was something to aim for and be proud of. Renting, conventional wisdom held, was throwing money away.

In fact, our whole tax structure was setup in such a way to significantly incentivize people to take out a mortgage and buy a house. Would we be in the financial position we are now if you didn't get to deduct mortgage interest off your taxes? Less people would have purchased homes and the government wouldn't have had to return all that cash after mortgage interest deductions--maybe the deficit would have been a little smaller. Maybe our own deficits would have been a little smaller, too, since buying a house tends to come with lots of little (and big) unforseen expenses.

Put aside the market crash for the moment. I think it might be worth reexamining our lemming-like participation in this asset class as a society.

Moreover, owning a home tends to keep you geographically anchored. Think about what society and the working world is placing a premium on these days--flexibility. People with an expertise--be it consulting, languages, engineering, etc.--go where the work is and get highly compensated for the "inconvenience". At the same time, people who can be flexible about their own cash outflows can take more entrepreneurial risks, whereas lots of people with good ideas or passions can't join startups because they have a mortgage to pay.

Your average Detroit autoworker, on the other hand, is not only in danger of losing his job, if he hasn't already, but, his family they can't even move. So forget the pie in the sky notion of getting retrained to take a cleantech job working on building and repairing windmills in the Great Plains, because they can't sell their house.

When I was at GM, we took part in the leveraged buyout of AMF, the bowling company. One of the first thing the buyout fund that led the deal did was to do a sale-leaseback. In other words, they decided that owning a bunch of real estate wasn't a good way to capitalize this business, so they sold it, put the cash towards higher ROI investments in the company as well as a dividend to the shareholders, and just paid rent as an expense.

Historically, bubble aside, owning real estate is a lower risk, higher cashflow investment--certainly meant to return less than the equity markets. So why do we push so many young people and young families to try and buy a home? Shouldn't they be putting their capital into potentially higher returning investments?

You might provide examples of real estate transactions that have worked for people in rising markets... and I'm sure there are lots--but the historical, long term performance of the asset class isn't that high. Excess returns from individual transactions not only incur a boatload of unsystematic risk (like that you accidently built the house on a sinkhole), but require alpha on the part of the manager. Like most illiquid/private asset classes, the diversity of returns among managers is very high. In other words... You can make a killing in real estate if you know what you're doing and you wind up getting lucky enough to bet on a good property, but don't be so quick to assume everyone can be better than average.

What are some of the other things young people might invest in. Well, think about my specific case? In order to buy an apartment (you know, since I did the silly thing of buying something I could afford), I moved out to Bay Ridge, Brooklyn, a 45 minute commute into the city. On average, I go into the city six days a week. That's about an extra 4 hours of time compared to if I was living in the city per week. Multiplied over a whole year, at a rate of $100 an hour (let's say I chose to do consulting with that time), you're talking about $20,000 a year. I never factored that cost in. Nor did I factor the social cost. Who am I not building better relationships with because I live further away? Isn't investing in my social network at this point a higher potential return than real estate as an asset class--especially given that I'm an entrepreneur?

So what would the issue be if we just rented our whole lives? People might say that you wouldn't have anything to leave to your kids--but we tax the hell out of inheretences anyway--not to mention the fact that you shouldn't need to buy a house to save money. Personally, I think if we de-anchored ourselves from one spot for a big chunk of our lives, we might be better suited to take advantage of career opportunites, meet new people, and experience new things. Tell me where the flaw in this argument is.

My Fantasy Draft Results

12 team league, $260 salary cap and I had reserved 5 players from last year at $5 more than I was carrying them: McCann, Pedroia, Span, Galarraga and Morrow.

C $15 McCann, Brian (C ATL) C · DH

1B $10 Delgado, Carlos (1B NYM) 1B · CI · DH

2B $16 Pedroia, Dustin (2B BOS) 2B · DH · MI

3B $15 Jones, Chipper (3B ATL) 3B · CI · DH

SS $8 Aviles, Mike (SS KC) 2B · DH · MI · SS

MI $1 Getz, Chris (2B CHW) 2B · DH · MI

CI $1 Konerko, Paul (1B CHW) 1B · CI · DH

OF $24 Holliday, Matt (OF OAK) DH · OF

OF $15 Young, Chris B. (OF ARI) DH · OF

OF $6 Choo, Shin-Soo (OF CLE) DH · OF

OF $23 Hart, Corey C. (OF MIL) DH · OF

OF $6 Span, Denard (OF MIN) DH · OF

DH $2 Francoeur, Jeff (OF ATL) DH · OF

P $3 Pettitte, Andy (P NYY) P

P $6 Galarraga, Armando (P DET) P

P $9 Ziegler, Brad (P OAK) P

P $13 Greinke, Zack (P KC) P

P $10 Lilly, Ted (P CHC) P

P $22 Matsuzaka, Daisuke (P BOS) P

P $37 Santana, Johan (P NYM) P

P $7 Capps, Matt (P PIT) P

P $6 Morrow, Brandon (P SEA) P

P $2 Cook, Aaron (P COL) P

RES $0 Sheffield, Gary (DH DET) DH

RES $0 Sanchez, Anibal (P FLA) P

RES $0 Wood, Brandon (3B ANA) 3B · CI · DH · MI · SS

RES $0 Crede, Joe (3B MIN) 3B · CI · DH

RES $0 Perkins, Glen (P MIN) P

Here's my assessment:

Pros: I'd definitely going to get a lot of wins behind Santana, Dice-K, Lilly, Greinke, Pettitte, Cook and Galarraga. Whether or not guys like Pettitte and Cook can keep their ERAs and WHIP at reasonable levels is a question. I could definitely win the saves category if Morrow and Ziegler pan out. Also, almost everyone's got some pop. Choo could be a sleeper. Who knows... Maybe Shef may get some burn down the stretch too. I hope Brandon Wood comes up soon.

Cons: No real big, unquestionable boppers. Chipper is older and an injury risk... and who knows what to expect out of Delgado. Let's of guys I can count on for 25/80, but not a lot guaranteed for 30/100. If Morrow and Ziegler don't pan out, I may need to find saves elsewhere.

Trading software for the PR exchange: How to get pitches out of the dark ages

Whenever I ask anyone for innovative ways to reach reporters, PR professionals point me to Peter Shankman's Help a Report Out (HARO) list. It comes out three times a day and gets sent to over 50,000 people. Reporters can post requests for everything from housewives who've discovered tantric sex to people who've turned down CEO positions (not *those* kinds of positions).

This is the bleeding edge of media relations, folks--a mailing list.

And thank God for this list--lest we all depend on these hand edited media databases selling for thousands of dollars. These sites make me feel like I'm searching Proquest back at my college library in 1999--cumbersome to search though and lacking the metadata I need to find what I'm looking for.

At least HARO gives me a sense of what a journalist as actually looking for *today*.

Do you know why there are half a dozen of these things out there? Most of the data is public! Media winds up on the web, so all the data is already out there. So far, I haven't seen anything that provides really specific insight into the current topics of interest of a reporter, nor any real analysis into how much traffic, buzz, and influence a journalist really has. The blogger information is quite rough, too.

And @microPR? I track it on Twitter... and it seems to be mostly people suggesting other people follow it for #followfriday or talking about its usefulness. Fail.

PR is a marketplace--an exchange of relevant, interesting information for attention and audience. So why doesn't it have the tools of a marketplace? PR tools shouldn't look like databases... they should look like financial trading platforms, with asks and bids on a ticker--filtered for what I'm looking for or need. This is trading: I give a reporter information (and an angle to work with) about my company and he gives me his audience's attention--at least to the extent he influences it. Real marketplaces have transparency, quantifiability, uniform elements of exchange, and the information systems that enable both sides to make informed decisions.

Imagine if you bought and sold stocks the same way PR works today. You'd maybe list your name (or have someone else list you with questionable accuracy) in a database. Instead of really detailed information related to your risk tolerance, prior stocks purchased, key financial criteria like cashflow, all people could see was a general description that you were interested in "Tech Stocks". Nevermind that you're specifically interested in bigger name plays like MSFT, GOOG, and AMZN, you now get tons of requests for you to buy tiny little biotech companies with no profits that you've never heard of. You get these requests in your inbox...and they just keep coming. You don't have time to answer them and there's really no good way to inform the investor relations world about your interests.

PR,specifically pitching, is just like Wall St.--in the 1780's: Manual, opaque, and lacking the tools to create real actionable information flow and analysis.

Getting PR is all about recreating the work that lots of other people have done to find good contact lists, which will always be incomplete and never really that accurate, crafting good pitch letters, which is totally not scalable, after hours schmoozing, and brokering exclusives in a world where information just wants to be free. This is why the startup geeks can't hack it and need to hire firms to do the social dirtywork. They're too frustrated by the archaic process, lack of feedback and randomness of success to count on it as a good way to spend their time--especially when most media drives a seriously underwhelming amount of traffic.

Here's an idea for a better system--one that treats PR like the information marketplace that it really is:

First, index all of the reporters. A good web crawler should be able to recreate the best online media databases in a very short amount of time. Match them up with feeds for their stories, twitter accounts, del.icio.us tags, etc., and analyze the topics and keywords they talk about in real time. Also analyze the words that other people use when tagging, tweeting, and reblogging their stories. I don't just want a list of career columnists who give resume tips. I want to know who is reviewing career websites and who isn't--and specifically ones focused on data and analytics or who have an interest in startups and innovation. Computers can figure that out a lot faster than people can.

Media outlets need the same thing. They need more information to sort through the pitches in their inbox. Who are these people? Are they backed by the right people? If I were a reporter, I'd want to know that Path 101 is funded by folks like Fred Wilson, Brad Burnham, Scott Heiferman, Jeff Jarvis, etc., and has recently appeared in CNN/Money, VentureBeat, and Mashable. Moreover, the fact that I was #61 on the SA 100, or that Hilary is a regular FooCamper might be of interest, too. I'm not bragging... I'm saying that if I was a journalist and thought of the PR process as an exchange, I would certainly equate some value the networks of the companies I choose to write about, all other things being equal. I know I certainly go out of my way to try to connect up reporters who've helped me out with other people I know, like angels and VCs involved with us, their portfolio companies, etc. If nothing else, reporters undoubtedly need some kind of filter, short of a background check, to figure out who's even legitimate. I know I needed this when I was on the venture capital side getting inbound biz plan pitches. Just because someone has the money to hire a PR firm doesn't necessarily make them the kind of people I might want to get involved with--but the interwebs can tell me a lot about "counterparty risk"--who I'm getting into this trade with?

Create a filterable, searchable open market for requests and pitches, with APIs, like Twitter, so I can have it on the web, desktop, e-mail, etc. Mailing lists and Twitter accounts are archaic... and force people to sift through a whole bunch of irrelevant stuff. When a reporter asks for new resources for career guidance, not only does that person get our Path 101 info, but so does anyone else writing something similar. Give reporters the analytics around how much coverage a company is getting, how recent, etc--make the whole process transparent.

With historical analytics, I should be able to go back in time and say "Show me all of the reporters that wrote about NotchUp and sort by rating and by most recent date of relevant stories."

At the same time, reporters should be able to create saved searches for "career resource", "career guidance", etc. so that they can see a running ticker of what's being pitched. Why should they have to wait to be pitched? When investors want companies that have Low P/E's, they can screen for that. Why can't reporters screen the universe of pitches?

Allow for ratings on both sides. Some reporters write really thoughtful pieces, even when negative, and others are obviously mailing it in. Let PR folks and companies rate the reporters. Undoubtedly, some startups are a total PITA. If you get spammed by the same startup everyday, as a reporter you should be able to ding them. It should be easy for a reporter to find out who is generally useful to talk about a particular topic regardless if they have something to pitch. Rating expertise on both sides would be great.

The other thing about ratings on pitches would be to allow specific feedback. If I pitch a reporter, they should be able to easily click something to move on to the next one, but at the same time give me some feedback. A stock set of responses to choose from would be great:

"Interesting, but I have enough for this request already."

"My mandate has changed."

"Too early."

"Not relevant."

On top of that, they could suggest future contact with another click:

"Let's talk in the future."

"Please don't contact me anymore."

"Let's talk right now. Call me."

Otherwise, your pitches will probably go into a black hole. Who has time to respond to every single pitch they get by e-mail?

Also, let's come up with some objective ratings on traffic and influence. Did the story drive any traffic? How much? Was it reblogged, tweeted by others? Did the users convert? This is really what companies care about. It's great that a site gets a ton of traffic, but if the users from that site never convert, what's the point?

What would this do to PR firms? The general availability of great financial research tools to the public hasn't made the mutual fund and investment manager industry go away, has it? No. So there's no reason to think that PR firms need to go away. Great tools should be able to cater to PR firms and individuals at companies who want to do their own PR alike, the same as in investing. We're far from great tools at the moment and what's out there costs entirely too much for the amount of work it still leaves you with.

My recent tracks on Last.fm

The most recent tracks I've been listening to on last.fm:

SlideFail: Making fun of yourself: Ok. Getting your users to embarrass themselves in front of their own networks: Not cool.

I got an e-mail from Slideshare this morning:

Hi ceonyc,

We've noticed that your slideshow on SlideShare has been getting a LOT of views in the last 24 hours. Great job ... you must be doing something right. ;-)

Why don't you tweet or blog this? Use the hashtag #bestofslideshare so we can track the conversation.

Congratulations,

-SlideShare Team

I assumed it was because of my Educational Outcomes presentation... that maybe some group of educational administrators finally decided they wanted to know what happened to their students after they graduated and whether school was worth all that money.

I checked and suddenly it had over 100,000 views. It was around 500 the last time I checked it. Something was odd. I went searching bit.ly, Google inbound links, Twitter search... couldn't figure out where the traffic was coming from and spent a fair bit of time trying to track it down. Someone else asked on the nextNY list and then I realized it was a joke.

I responded "I think it's a joke" and the guy wrote back:

"If by "joke" you mean "obnoxious social media d-baggery joke of an effort at guerrilla marketing" then yes, I agree."

I can't say my own opinion is far off from that, which is a shame, because I really like Slideshare. It's an awesome service that I recommend all the time.

The problem with the joke is that they asked me to tweet the presentation out using their hashtag--which meant that all of the people who fell for the joke would be easily findable. Not only that, but what they really wanted to see was for me to tweet out to my network that I thought my presentation got 100k views, only to have to retract it later and look like an idiot.

The people who put things on Slideshare are professionals. These aren't videos of two 14 year old girls lipdubbing Lady GaGa. These are pretty serious presentations, often given at conferences, and those people who are using Slideshare are undoubted connected on Twitter to their professional networks. To try to coax them into looking foolish in front of those people just isn't cool.

April Fool's Jokes are best done when everyone knows it's a joke, they're done a little tongue-in-cheek, and they poke people a little bit, but not at their own expense. The Smellr site was hilarious... and at worst, it may have bruised the egos of some already wildly successful people--not rank and file users who are actually trying to get their presentations seen and would be disappointed when the views turn out not to be real. That's not who you should be picking on today.

My del.icio.us links

Links I've recently tagged on del.icio.us:

I tagged it with: recruiting, hiring, interviews