The March to 1000

So, after moving all of my stubborn Typepad feed consumers to Feedburner, I received a bump of 100 subs. I'm now up to 750.

I'll be honest, its hard not to look and to get excited when it goes up.

But to be honest, what it should really be, at least for anyone who blogs about their industry and is looking to make professional connections, is a measure of your contribution to others, not their consumption of you.

So, as the theory goes, if I make an intentional effort to post more useful things here, take part in more conversations by linking to other blogs and commenting on other blogs, my subscriber numbers should go up--more so than if I was just trying to get more people to come here to read.

Its a subtle philosophical difference, but I think it means a lot in a culture of authenticity.

So, basically, I'm going to try, over the next month, to contribute a 1000 sub's worth of value.

Paying to meet entreprenuers and VCs

There are a handful of people making great little businesses out of introducing the best ideas to the cash and advice needed to make them great.

Frankly, I'm not a fan of this model at all.

I don't think you should have to pay to meet a VC if you're an entreprenuer. You should be able to pour all your money into your idea, making it successful and visable enough to garner interest from the more aware and relevent VCs in your space.

So if you're an entreprenuer debating whether or not you should "dress up and save up" to present at a big conference or even a local "summit" to meet people who might fund you, well, you can do what you want, but I just don't like the principal of the whole thing.

I think we should be paying to meet you. I mean, the reality is, while a startup can bootstrap itself and doesn't necessarily need VC money, a VC fund can't bootstrap itself. Without entreprenuers, VC funds don't exist, but the same is not true in the reverse. We need you more than you need us, so an entreprenuer paying to meet us seems like it should be an economic anomaly.

What do you get when you cross The Bridges of Madison County with Speed?

What do you get when you cross The Bridges of Madison County with Speed?, originally uploaded by ceonyc.

The Bridges of Speed County.... Ummm... I mean, The Lake House.

"This house will explode if our love goes below 50 miles per hour..."

Gag me a river.

Betting on Character

Remember Rick Ankiel? At 20 years old, he started Game 1 of the NLDS against the Braves in 2000.

He took a lead into the third, and then had a complete meltdown. He threw five wild pitches, walked four and that was about all she wrote for his whole career. Not only did he not have what it took to pitch in the playoffs, but his performance so shattered his confidence that he never succeeded again in the majors.

And conversely, look at Mariano Rivera and flash back to 1995. (I know... he plays for the bad guys... I'm just trying to make a point here.) Rivera was a starter when he first came up... made 10 starts actually... and finished the year with a 5.51 ERA. Nothing special by far. But all it took was 5 1/3 innings of shutout relief in the first round of the playoffs against Seattle to see that this was a guy who thrived when the game was on the line in a clutch situation.

Rivera had "it" and Ankiel didn't... and there was nothing up until those key series for each player that could have predicted their success. There wasn't a scouting report out there that could have told you enough about their mental makeup to clue you into whether they would wilt or shine in a tough spot.

And even if there was, its still a matter of what happens on the field. A lot of people show their character in different ways. How about John Rocker? Sure, he was mean, angry...etc... things you'd probably normally want in a closer... but he turned out to be a complete head case.

So, while velocity and control might be key measures of effectiveness to a scout, a lot of the times what is really predictive of success has nothing to do with a person's natural talent. That sometimes makes predicting success an exercise in character judgement more so than it does a job of looking at someone's historical track record. Should scouts be conducting character reference interviews? I wonder if they do at all.

What about as you are building a company? Particularly in venture, when you might be asking people to do things that no one has ever done before, a lot of times, you find yourself betting on character. This is made so much more important because of the size of the staffs you are adding to. If employee #5 is a bad hire, its a lot worse than a bad hire for #5000.

So what are the keys to checking someone's character out and also the rightness of fit with an organization? Certainly, you've got to sit them down and put them in front of as many people you know and trust as possible. That was certainly a key for me when I got hired. While Brad and Fred never bothered to check out my resume, because they saw my work first hand in my due diligence of their fund, they focused in on my references and the impressions I made on people in my office. I'm quite sure that my interview with Kerri, because I was going to be sitting right next to her, was probably just as important as whatever I had put on my resume, had they seen it.

I guess its a little bit like dating. You just don't know exactly if you're going to be a match, and no profile, quiz, etc. is going to prove compatability for you... sometimes you just have to take a chance on someone you get a good feeling from... someone you wouldn't mind facing a little bit of the unknown with.

Find search engines across the world with Search Engine Colossus

Fuckin' bike flat... maybe I'll walk home to Bay Ridge today.

Link: ABC News: Police Investigate New York Subway Terror Threat.

The New York City Police Department is investigating what it deems a credible tip that 19 operatives have been deployed to New York to place bombs in the subway, and security in the subways will be increased, sources told ABC News.

Find search engines across the world with Search Engine Colossus

Link: Gothamist: Critical Mass Clashes with Police Again.

New Yorkers, probably more than any other kind of people, are really good at making issues out of things that shouldn't be issues. The combined mental and emotional effort that has gone in to these silly bike rides could be spent doing lots of other things that would make much greater impact on society. How about helping kids to read, spending time with the elderly, or feeding the homeless. If I was sick in a hospital bed, watching TV because I had no one to visit me, and I saw these people protesting their "right to bike in a big group", I'd be pissed. And then, I'd probably cry. So, next time one of these mass rides comes around, instead, why don't you think for a moment about how you can directly improve the life of one of your fellow human beings. Spending more time with your family counts, too. You should be ashamed of yourself if your best contribution to the good of society is causing traffic.

The Need to Build (or Smash and Break)

Over the weekend, I installed a ceiling fan in my bedroom.

Now, you might not think this is such a big deal, but keep in mind that I've had absolutely no experience dealing with anything electrical whatsoever. I think it runs in the genes, though, because my grandfather could do almost anything with electricity. He used to have this little bulb with two wires on the end of it that he would use to test to see of the sockets he installed were working.

Of course, it would have been easier and probably safer to have an experienced professional do this for me, but I just had to take a crack at it myself. My "flashlight helper" was betting that I'd "smash and break" something...most likely me.

Once I think I have some understanding of how a system works, I can generally take a very methodical approach to dissecting it and problem solving. This one included turning on all the lights and appliances to map my circuit breakers and figure out which switch controlled which outlet. I went to Home Depot to get the fans and also pick up some rubber handled pliers and a wire stripper.

What I realized yesterday and what I've been thinking about since my last review here at USV is that this is the kind of challenge I'm really meant for... taking something new to me apart, figuring out how it works, and taking a crack at building it up.

When I first joined here, it was pitched to me as a two year position, but to be honest, I largely ignored that. I sort of figured that I'll just make myself so totally indespensible that there's no way anyone would want to get rid of me. Then, after a while, seeing the tech landscape evolving, meeting smart entreprenuers who tackle tough problems, and seeing the business world get changed by the power of the consumer, I've had this growing urge to want to join the fray.

But really, who doesn't? (And who isn't?) I guess what I'm saying is that I'm slowing realizing that this isn't a new thing for me... that this need to be in the middle of the building process goes back to when I used to sit on my bedroom floor and build sprawling LEGO towns.

So what does that mean for me next? Well, first off, I'm a big believer in the idea that you don't go anywhere unless you get the job at hand done first. So, I'll still be nose to the grindstone here at USV working on all the great deals we're looking at now. (We're closing on two this week... news to come...) But as I look at these deals, I'll also be looking to try and understand where it is that I think, should the opportunity arise, where I could have the most positive impact by working more closely with a company.

So, as I write here, don't be surprised if I start doing a lot of self assessement, thinking about my future, etc. I certainly welcome any conversation from people in a similar boat and I've been talking to a lot of very experienced mentors and peers lately about the subject.

Should NYC Tech Companies Hire a Blogger?

When Brian Oberkirch showed up at our last nextNY gathering, we talked about how, if this were the Valley, we would have had 50 pictures of us uploaded to Flickr before the night was through. Instead, we had to find somebody with a camera... one of like 5 people out of our group of 150 with a Flickr account.

And we have a whopping 11 bloggers among us... (Actually, 12... that I know of. Someone didn't even bother adding their name to the wiki.)

Are they disinterested? Not at all!! In fact, we're running an "Community Conversation" about all the nuts and bolts stuff it takes to take your idea from napkin to real company, called "Startup 101".

In just a couple of days, we're basically all filled up... 45 attendees... pretty much all young entreprenuers building startups, outlining ideas, consulting others. So, they saw something informative and jumped all over it.

But, I'll bet you I'll be the only one there with a camera.

New Yorkers seem to have a different view on the value of buzz and splash... at least in the tech community. Maybe its the fact that, despite being the 3rd largest area for startups in the country, tech is never going to be the #1 thing going on in this city, so people don't even try to be "rockstars". Tech buzz is slow in this town, contracted with actual tech action which has heated up and is boiling over at the moment. There are a ton of new startups popping up everyday and lots of great events to go to.

It just doesn't seem like it sometimes if you check out all the usual Web 2.0 channels.

Perhaps its a PR issue.

So I was thinking... what if, instead of spending all their PR resources on promotion of their own companies, what if a big group of VC firms, tech companies, etc. got together and all chipped in a little bit to put a blogger on the street. Arm them with a camera and a digital audio recorder. Let them blog every event, do podcast interviews at the NY Tech Meetup, and Flickr the nextNY events to death. And seriously, there are a ton of events. We've got conferences and user groups... dodgeball tournaments, too! Maybe the WSJ or the NYT should do it... but seriously there needs to be someone whose primary focus is making sure everything going on in NYC is properly reflected in the Web 2.0 glob of buzz.

Buzz goes a long way... it goes a long way when you've got college grads from Carnegie Mellon and Urbana Champlain deciding whether to code their way east or west... when you've got companies trying to figure out where to set up shop... or even when people here are deciding whether or not to manage IT systems for Goldman Sachs or be the CTO of their best friend's startup. We all need to be doing a much better job of representing our NYC community here on the web, but I think supporting someone doing it fulltime might be a good addition to the conversation.

To contract work or not to contract work?

Good article from a local entreprenuer on whether people working on startups should also be doing contract work.

My Secret Spot...

There is a parking spot in Manhattan that is governed by no traffic rules whatsover. None.

No alternate side parking. No muni-meters. No commercial parking only. No street cleaning, no no standing, no no nothing.

And yet, no one parks there... ever.

Its a completely free, completely empty spot on one of the most traversed roads in the whole city--the most valuable secret in all of NYC.

I know, because I have seen it with my own eyes. I have even parked there. Before yesterday, it was just for a few hours at off times here and there.

Now, it has passed the ultimate test. I had a breakfast meeting in midtown at 7:30, so I drove in and parked around 7. It was a 10-12 minute walk to where I was. I went to work, met someone for dinner, then went to teach my class at 8.

I didn't get back to my secret spot until 10PM.

Car?

Still there. No tickets.

Fifteen hours of undisturbed, unticketed, completely free parking, 10 minutes from midtown.

I kid you not, my friends. There is a spot the Department of Transportation has forgotten... has overlooked. It is 20 feet from a hydrant and down the block from a no parking anytime zone.... but this spot is completely free of any legal jurisdiction whatsoever.

I dare not park their everyday, for fear of giving away its very existance to the proper authorities, but I will definitely use it at my leisure for late nights in the city where I know I won't want to hike home on the subway at 11 or 12.

Forget great sushi. Forget great apartment finds. Forget midnight hookups on C/L.

I have found the Holy Grail of living in New York City. Parking. Free. Anytime. No limits.

Venture Capital is not an Asset Class

Coming from the Limited Partner side, I've had the opportunity to see investing in private equity from high level portfolio allocation perspective... leveraged buyouts, venture, distressed investments, etc.

It always struck me when people talked about making an "allocation" to venture capital, as if it was somewhere that you could just stick a lot of money and get something close to historical returns. Not only is that not true, but I think that what most institutional investors even call "venture capital" is a terrible catch-all for a pretty diverse set of investment strategies across a number of uncorrellated industries.

I mean, should a $50 million investment in a profitable and growing healthcare services company from a group like Summit Partners fall into the same "asset class" as a small angel/seed round in a company like del.icio.us that started out with one guy and one server? Do those investments have any correlation whatsover?

Granted, when the public markets are doing well, rising tides tend to float all ships and that's when you get outsized "VC" returns. But, keep in mind that one of the best venture investments ever, Google, was made during one of the worst possible periods of venture investment... ever. Google's first VC round game in June of 1999. How many other companies that got their first round of investment in June of 1999 are even still around? Selecting from that vintage would be an exercise in catching... well... forget falling knives... try falling hand grenades... oh, and one golden egg, of course.

The reality of venture capital is that its a relationship business where reputations and industry expertise count. You're betting on people... people who are betting on other people. The idea that you could group all of these people in one bucket and make assumptions and predictions that all of these people are going to move in step always seemed a bit silly to me. Just because you can aggregate data doesn't mean you should.

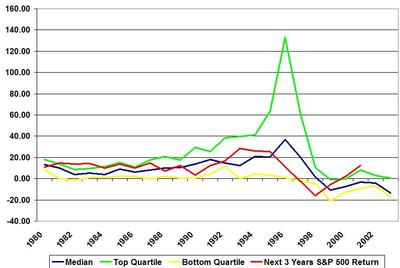

In fact, if you're not betting on the right people, its really not even worth being in this "asset class" to begin with. Take this chart. This chart plots "vintage year" returns across time of the top quartile, median, and bottom quartile of VC funds. So, for example, this chart says that the green spike is the aggregate IRR of the top quartile funds that began in 1997. So, that money was largely put to work in '97, '98, and '99, and those companies exited in the '99 and '00 timeframes... a great time to exit, but not a great time to start putting your money to work as you can see from the really low returns garnered by even the best managers who raised their funds in '99.

I plotted these returns against the next 3 years returns from the S&P. Its not exact, but it gives you a sense of what your money would have been doing in the public market over the next few years if you had put your money in public stocks as an alternative.

I plotted these returns against the next 3 years returns from the S&P. Its not exact, but it gives you a sense of what your money would have been doing in the public market over the next few years if you had put your money in public stocks as an alternative.

What is says is that venture really only makes sense if you are with the right firms. Even the median venture manager doesn't outperform the S&P 500, particularly when you take risk into consideration.

So when people say, "I'm bearish on venture" are they talking about median managers or top folks, because I'll always be bearish on median managers, but I'd be happy to invest with the best of the best, no matter what the market looks like for public exits, IT spend, etc. In fact, it is great innovation by the best of entreprenuers that often drives these markets and spending. I'm sure any CTO would find the money for the next big idea that solves all of his or her problems no matter what their budget looked like.

The bottleneck here is access. Not everyone can get into the best managers. In fact, if you're a new investor, you might even have trouble getting into even the second tier. But everyone who invests on the LP side thinks their managers are the best, right? And obviously, not everyone can be the top quartile, as the saying goes. How many people are top tier? Who are they? Well, that's a whole debate in and of itself, but I'm just more concerned with the idea that investors look at venture capital as a homogeneous set of investments that can be slotted into an efficient frontier, because its quite the opposite. Investors need to consider their own opportunity set, due diligence their managers thoroughly, and make bets on people the same way VCs do. How much money could you actually put to work with managers you think you have the right relationships and industry knowledge to succeed?

I mean, can you imagine if we decided here at USV to make a 25% allocation to "online advertising" and put our money out that way, regardless of what kind of entreprenuers walk out the door? Certain not a good style of investing and not the way I'd pick VCs either.

USA TODAY Archives Search

So I was just clicking around my blog looking for something, and I noticed something weird about my last 50 Favorite Movies post. It had an Amazon ad on it... not the link to the DVD that I usually have, but an actual ad--an annoying flashing/blinking one at that, too. I figured I pasted the wrong link or something, but then I went back and realized that about half of my movie links had turned into ads.

So, I pasted a link to a DVD that I'd like to sell as an Amazon Associate, and Amazon's been switching my links out for house ads.

That's pure bullshit.

I don't care if it says that they can in small type somewhere, that's just wrong. I set up those links so people could find the movies I'm pitching... not so that Amazon can have ad inventory just to promote its big sale.

That's totally obnoxious and as soon as I get a chance, I'm going to go back and rip down my Amazon links.

Amazon Associate? No thanks. I'd rather not "associate" with them on my blog if they're going to pull that.

I'd rather give IMDB the traffic.

Here's the picture of what they put up on my site:

WIRELESS TOYZ

Link: tony morgan | one of the simply strategic guys: 10 Easy Ways to Know You're Not a Leader.

10 Easy Ways to Know You're Not a Leader

1. You're waiting on a bigger staff and more money to accomplish your vision.

2. You think you need to be in charge to have influence.

3. You're content.

4. You tend to foster division instead of generating a helpful dialogue.

5. You think you need to say something to be heard.

6. You find it easier to blame others for your circumstances than to take responsibility for solutions.

7. It's been some time since you said, "I messed up."

8. You're driven by the task instead of the relationships and the vision.

9. Your dreams are so small, people think they can be achieved.

10. No one is following you.

I'll add a few:

11) You can't/don't take the time to understand people who disagree with you.

12) You don't create other leaders.

13) You have to make every decision yourself.

Here's my Craigslist story...

So, yesterday afternoon, I played a pickup softball game with some Zog folks.

But, unfortunately, I left my new glove at the field. :(

I could have kicked myself.

Seperately, I have a Zog softball game tonight and I'm short players for it. I posted on Craigslist and this guy named Gary responded. I picked up a few players and now I think I'm good (but if anyone wants to join us, let me know... its a 6PM game on 101st/Amsterdam). Then I realized that I should probably post in the lost and found section about my glove, too.

So Gary responds again and says, "Hey, wait... were you playing with ZogSports last night?"

Turns out that not only did Gary play first for the team I was on, but he also spotted who found my glove and took it for safe keeping. I guess he just has an RSS search going of anything to do with softball. So the glove has been located, some ringers have been added and Craigslist saves the day.

USA TODAY Archives Search

Link: Allen's Blog.

Allen Morgan from Mayfield is a VC blogger who seems to have been blogging under the radar compared to guys like Fred, Ed and Brad. He is currently posting his 10 Commandments for Entrepreneurs... really great stuff and a must read for anyone looking to get VC funding. While I'm sure this post will help a lot of startups, I'm sure it will help Allen as well... making meetings with entreprenuers as effective as possible, which would be important given the lines out the door that must form at a VC firm with a reputation like Mayfield.