Fundraising is Biased and Broken. It Also Works Pretty Well and Isn't Going to Change

Everything you’ve heard about fundraising—all the worst things about it—are largely true.

Yes, straight white dudes get most of the money.

Yes, biased straight white does dole out most of the money.

Yes, many of these founders are pitching dumb stuff that gets funded all the time—especially by people they know.

Yes, someone else in the Silicon Valley insiders club got way more money than you for basically the same idea, even though you were first.

All true.

Here’s the other truth: The venture fundraising process actually does a pretty good job of distributing capital to the founders with the best chance of creating big financial outcomes.

The Nicest Place on the Internet

There aren’t a lot of places you can go online that genuinely make you feel good—and that bring out the best in you…

…especially in an election year.

That’s why when you’re in a social network for over a decade and you’ve never ever seen a negative post, gotten into an argument, or never felt worse about yourself for the time you spent on it, it really stands out.

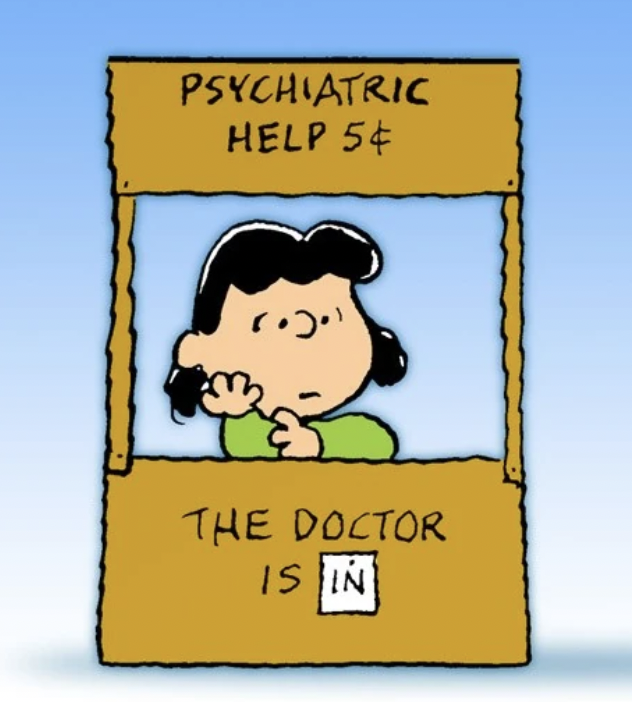

What I Learned Coaching VCs for the Last Year and What’s Next

About a year ago, I asked why more VCs aren’t using coaches.

Given the uncertain career paths for VCs, the unique dynamics around partner promotion within and across firms, and lack of clear direction on how to best spend your time on a day to day basis, it felt like investors would benefit from talking to someone who could provide some guidance.

After all, it’s something they recommend founders do.

What followed was a stampede of newly minted associates, ambitious principals aiming for partnership positions, emerging GPs navigating their firms through fundraising, and even a few experienced partners looking to optimize their time in order to compete with up and comers.

I honestly wasn’t prepared to handle the interest—and it didn’t stop. Every week, new VCs inquired about coaching even though I had barely put it out there. I wasn’t intending on making coaching my main activity, but I found it incredibly rewarding.

I coached investors to promotions, first board seats, internal personnel decisions and even a long overdue resignation.

Here are a few key things I’ve learned...

Thinking About Proximity and Optimization in a Job Search

If you’re in venture capital and you’re trying to make partner somewhere, should you get some operational experience somewhere and then come back? It’s a question my VC coaching clients ask all the time.

Yes! 100%.

You should be like Sarah Tavel. You should source Pinterest while at Bessemer, then “[join] as a "utility player" before we had product managers, and [become] the first PM at Pinterest.”

That will lead you to ultimately become a Partner at Benchmark, one of the top venture capital firms in the entire world.

Easy peasy.

Of course, you just have to find the next Pinterest, which IPO’d for $10 billion, but that’s just a small detail.

The Tech Industry and VC Case for Kamala Harris for President

If the United States is going to continue to solve tough problems with technology, we have to have the ability to collaborate—to work together as a diverse population. That starts at the top, by example.

Kamala Harris represents the best American story we can write—the daughter of two PhD students from different cultures who came here to study. She went on to serve her fellow citizens for decades in the legal system and then in national elected office, keeping people safe and fighting for justice.

She even gets high marks from her husband’s first wife, who considers her a dedicated co-parent and a valued part of her family. This is the kind of person you would co-found a startup with—not a guy who destroys the careers of just about everyone who works alongside him.

The people who simply don’t get paid by Trump comparatively consider themselves lucky.

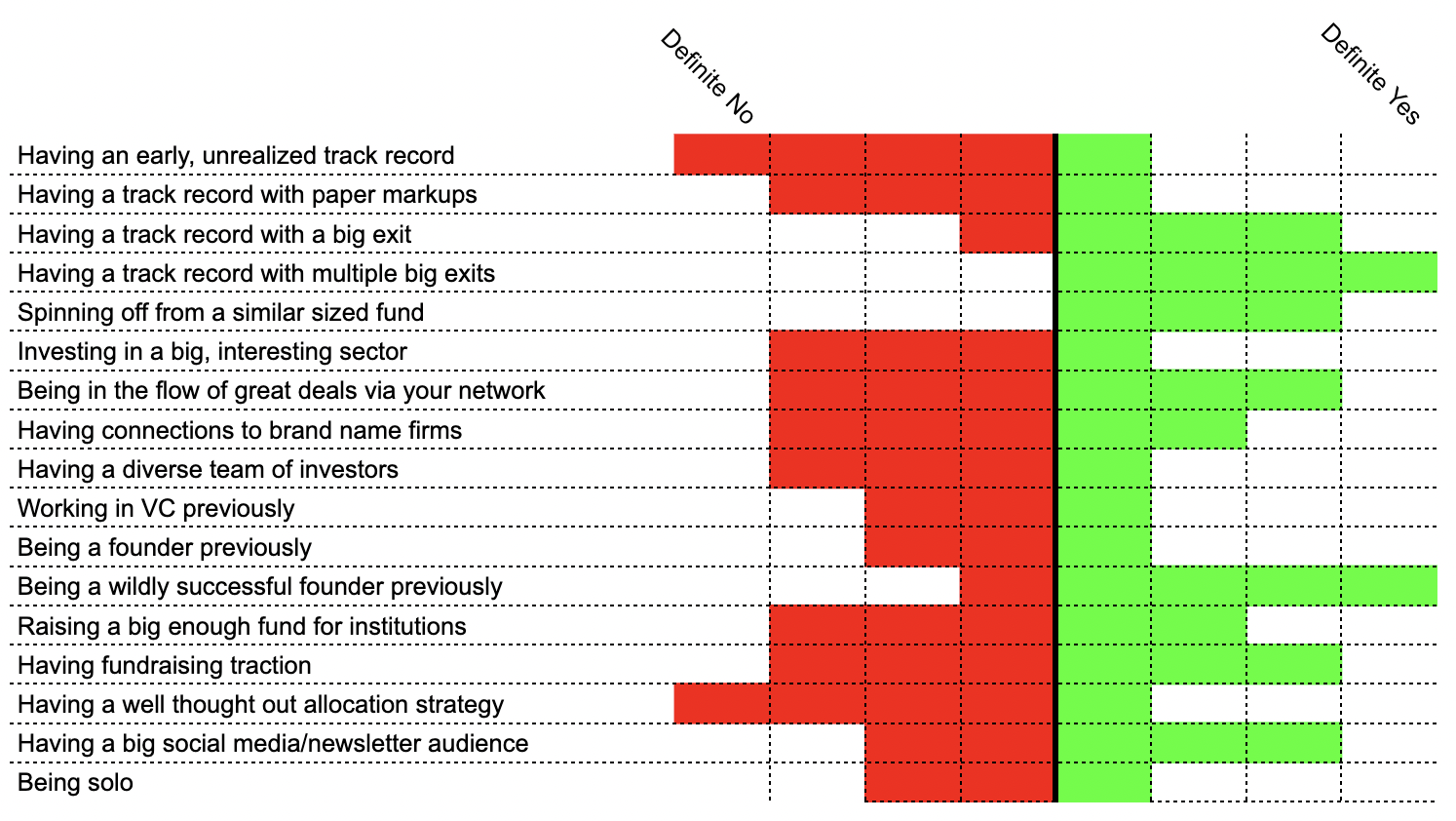

How to Objectively Measure the "Fundability" of Your Fund

Generally speaking, I think it’s easier to answer the question, “Is this manager going to be sought after to fund the best opportunities in X space/geo/etc?” than it is to try to figure out whether an individual founder will be successful with a particular startup idea. Once you’ve answered that question, you can dive into their ability to sort through their deal flow, do deal selection and the administrative functions of running a fund. Most of the criteria I listed above is all about being someone the very best and highest potential founders want on their cap table—and that’s the most important path to having great returns.

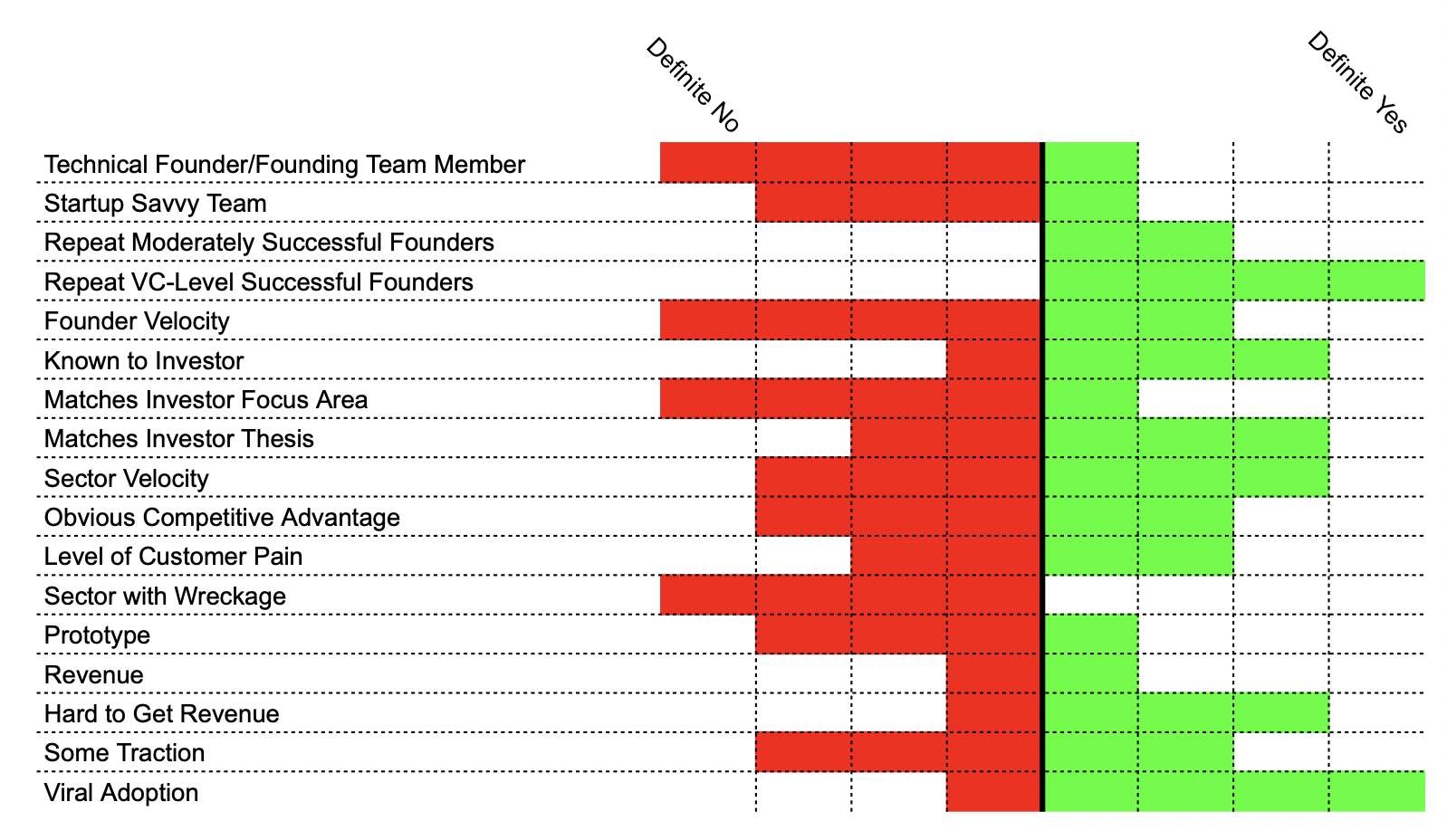

How to Objectively Measure the "Fundability" of Your Startup

The fundraising process sucks for about a million reasons—not the least of which is that investors often lack clarity and transparency in their communication. Still, there is somewhat of a method to their madness. Because feedback is usually given quickly and somewhat dismissively due to the sheer size of the average VCs funnel, founders walk away from the process feeling like VCs didn’t quite understand what they were doing, or they don’t understand the market.

This is some of the worst thinking anyone trying to make a persuasive argument can make—that if you only fully understood me, you would agree with me.

Founders need to shift their thinking to an assumption of understanding—that investors who see thousands of pitches per year probably do understand what a founder is doing the vast majority of the time, and have simply decided that the risk/reward for investing in their company simply isn’t as good of a deal as others they’re currently looking at.

That’s a hard pill to swallow—that perhaps you’re objectively not measuring up compared to other companies. This can be the case at the very same time you’re experiencing bias, microaggressions, and discrimination.

Learning When Leaving

The due diligence question I got asked most when I started was whether or not I could continue to source good deals outside of First Round Capital, where I had worked as a Principal before starting my fund. I spent a lot of time telling investors how much I didn't need that brand because it was helpful to my fundraising pitch. I wasn’t being negative—I was trumpeting my ability to be independent.

I certainly wasn't going to say, "Oh, yeah, that's going to be hard--First Round is a great brand and has a tremendous network of resources that would make me a better investor. I'm going to need to work twice as hard to piece that together independently."

How successful would that fundraising have gone?

I have no idea, because that’s not what I did.

If I had that mindset, I would certainly have become a better investor and I can see that now.

Themes vs Verticals: How to Stand Out as a VC Building a Thesis

Articulation of a focus area accomplishes a few critical things for an investor:

Inbound content marketing for deal flow—because you want your brand to get you on a founder’s list of smart people to talk to, especially if you don’t think the brand of your firm and your position within that firm will guarantee you all the best deals.

A focus and filter for networking—because otherwise, you’ll find that you could wind up in a meeting with anyone for any reason because any connection could theoretically lead to a future deal.

It signals expertise—because the best founders like talking to someone they don’t have to explain remedial things to, let alone someone who at least has an interest in what they’re doing.

The question is what to focus on.

Why Should a Founder Meet With You?

I’ve been coaching a lot of non-partner VC professionals and their number one challenge (besides taking obligatory meetings that their GP throws over the fence at the last minute—GPs, why do you do this? Stop wasting your team’s time and a founder’s time. Just pass when you think it’s a pass.) is trying to figure out how to get in front of the best founders with a title like Senior Associate or, potentially worse, Investor, which everyone assumes means Senior Associate.

Don’t get me wrong. There are very smart, likable, and helpful people in these junior roles—but compared to a partner, if you’re on the Associate level, you have no juice when it comes to getting a deal done. As a Principal, you have some juice. As a Principal at First Round, I got nine deal approvals in two years—but it was a lot more work for me than it would have been for one of the partners.

Even if your firm does allow you to lead or you were instrumental in a deal getting over the line last year, it’s actually better to act in such a way that everyone’s assumption is that you can’t lead. This way, you can challenge yourself to come up with another reason for a top founder to meet with you than as a conduit for capital.

Appropriate Accessibility: Announcing nextNYC Open Office Hours

It’s easy for a VC to just stick within your own networks and filter bubbles—and hard to scale being “open” without opening the floodgates. I sought out ways to be open for limited, manageable segments of time, because I found it valuable and inspiring.

A couple of years ago, I had the idea that I wasn’t alone in thinking this way—that if you could make it easy to for VCs to meet a bunch of folks in a finite amount of time, they’d be open to the idea knowing that some of these founders might be early in the progress. I asked a bunch of investors I knew to sign up a widely distributed Open Office Hours—across firms and across places, wherever investors wanted to meet. We had 70 investors sign up!

We Should Have Real Primaries Every Election and Support the Winner

We should always do this—having incumbents encourage and welcome healthy competition of ideas, as long as everyone supports the winner in the end. This happened with Biden and Bernie Sanders—with Biden ultimately letting Sanders push him to the left on some issues as the new White House set policy after graciously hearing him out in the debates.

There’s no reason why we can’t have real debates and real choices, and then once someone is chosen, support them in the general election.

But There's So Much Content Out There!

I know a lot of really smart, interesting people. That’s why I find myself telling a lot of people that I’d love it if they shared their thoughts more often in public. I don’t much care whether they do it in writing, or a newsletter, a podcast or on LinkedIn—but I feel like I every time I interact with them, I learn something or I’m inspired to think about things in a different way.

Yet, the response I get most often is, “But there’s already so much content out there!”

I’ve never quite related to that way of thinking—mostly because I don’t actually find most online content to be that good. Remember, you don’t have to outrun the bear. You just have to outrun the slowest camper—and in the world of online thought leadership, there are a lot of slow campers.

The Pros and Cons of Rando Rich People Investing in Your Startup

Say what you will about VCs, but we’re a mostly predictable bunch. You know what our incentives are and we care enough about our reputation within the ecosystem to not do anything too terrible—usually.

Still, there are a lot of downsides to taking venture money—the push to grow at all costs, our desire to be all up in your business, literally, and sometimes, we’re kind of obnoxious.

That’s why when you come upon someone outside the traditional ecosystem, there might be a lot of compelling reasons to take their money

Why It's Good to Be Transactional

To not be “transactional” and not think about specific goals like this is to be inconsiderate—which is not to mean “rude” but to quite literally lack consideration. You just didn’t think of me and what I might need or whether helping you is a way I might want to spend my time.

Or, you’re pretending not to know what you want or hiding it, in order to prevent me from having the opportunity to make that judgment myself as to whether or not this is going to be a fit. Sorry, but that’s not more polite or more human. It’s deceptive.

It's time to leave Twitter.

Two weeks ago, I opened X/Twitter and got pushed an ad for an anti-trans movie produced by PragerU and that was my final straw with this cesspool.

I immediately requested my Twitter archive of over 63,000 tweets over 16 and a half years. Not surprisingly, it took nearly two weeks for me to receive a link to it given how understaffed the company is.

Once I got it, I deleted my account.

I’m gone from Twitter for as long as Elon Musk continues to own it.

Level Setting and Career Goals for VCs: What level are Midas List VCs actually performing on?

I find level setting to be one of the most difficult things to do around any task or skill. Just how good is good? What are the best people accomplishing? How do you measure it?

It comes up a lot with my coaching clients who aspire to be top VCs and are trying to figure out how to self-assess and goal set.

I figured the best way to go about answering would be to ask the best of the best. Over the last couple of weeks, I asked everyone who has been on the Forbes Midas List over the last three years what their activity and accomplishment actually looks like in the functional areas of the job.

Besides being “busy doing great deals and distributing cash to your LPs”, what are they’re actually doing to make that happen?

The Advantage of Having Venture Backed Friends

I’ve made over 100 investments in my career and nearly half of those went into diverse teams.

I’ll be the first to back up the notion that diverse founders have just as much ambition, drive, intellectual horsepower, creativity—you name it—than anyone else. In fact, you could make the argument that, because of their lack of advantages in other areas, the ones who make it to a venture pitch actually have more of these raw ingredients because they’ve had to in order to make it to the same destination as their straight white male counterparts.

There is, however, an advantage that some founders have over others that I hate to admit exists—but one that I would very much like to solve for.

Questioning War

“Israelis & Palestinians do not deserve the consequences of evil forces that drive those who make decisions, profit from conflict, and push hateful rhetoric that make people lose their consciousness.”

This was a very powerful sentiment that I wholeheartedly embrace found in a very difficult to read (warning) Instagram post about the horror of the Hamas terrorist attack on October 7th.

This post is about considering the costs of war.

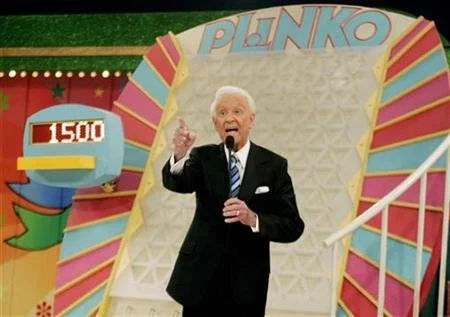

What Plinko Can Tell Us About Where to Post

What complicates the answers here is that there are some types of content that can live in multiple places (like a video) and others “types” that are so specific to a place that they’re expected to have a particular format (a TikTok video), yet they can still be transferred to other formats (a link to a TikTok video in an e-mail or placing that video on LinkedIn).

That makes trying to create a very simple-to-follow set of rules… well… not so simple. You can’t easily say that all video interviews should just go on LinkedIn because that’s the best platform or that Twitter is the best place for daily commentary on the tech world.