We Should Have Real Primaries Every Election and Support the Winner

We should always do this—having incumbents encourage and welcome healthy competition of ideas, as long as everyone supports the winner in the end. This happened with Biden and Bernie Sanders—with Biden ultimately letting Sanders push him to the left on some issues as the new White House set policy after graciously hearing him out in the debates.

There’s no reason why we can’t have real debates and real choices, and then once someone is chosen, support them in the general election.

But There's So Much Content Out There!

I know a lot of really smart, interesting people. That’s why I find myself telling a lot of people that I’d love it if they shared their thoughts more often in public. I don’t much care whether they do it in writing, or a newsletter, a podcast or on LinkedIn—but I feel like I every time I interact with them, I learn something or I’m inspired to think about things in a different way.

Yet, the response I get most often is, “But there’s already so much content out there!”

I’ve never quite related to that way of thinking—mostly because I don’t actually find most online content to be that good. Remember, you don’t have to outrun the bear. You just have to outrun the slowest camper—and in the world of online thought leadership, there are a lot of slow campers.

The Pros and Cons of Rando Rich People Investing in Your Startup

Say what you will about VCs, but we’re a mostly predictable bunch. You know what our incentives are and we care enough about our reputation within the ecosystem to not do anything too terrible—usually.

Still, there are a lot of downsides to taking venture money—the push to grow at all costs, our desire to be all up in your business, literally, and sometimes, we’re kind of obnoxious.

That’s why when you come upon someone outside the traditional ecosystem, there might be a lot of compelling reasons to take their money

Why It's Good to Be Transactional

To not be “transactional” and not think about specific goals like this is to be inconsiderate—which is not to mean “rude” but to quite literally lack consideration. You just didn’t think of me and what I might need or whether helping you is a way I might want to spend my time.

Or, you’re pretending not to know what you want or hiding it, in order to prevent me from having the opportunity to make that judgment myself as to whether or not this is going to be a fit. Sorry, but that’s not more polite or more human. It’s deceptive.

It's time to leave Twitter.

Two weeks ago, I opened X/Twitter and got pushed an ad for an anti-trans movie produced by PragerU and that was my final straw with this cesspool.

I immediately requested my Twitter archive of over 63,000 tweets over 16 and a half years. Not surprisingly, it took nearly two weeks for me to receive a link to it given how understaffed the company is.

Once I got it, I deleted my account.

I’m gone from Twitter for as long as Elon Musk continues to own it.

Level Setting and Career Goals for VCs: What level are Midas List VCs actually performing on?

I find level setting to be one of the most difficult things to do around any task or skill. Just how good is good? What are the best people accomplishing? How do you measure it?

It comes up a lot with my coaching clients who aspire to be top VCs and are trying to figure out how to self-assess and goal set.

I figured the best way to go about answering would be to ask the best of the best. Over the last couple of weeks, I asked everyone who has been on the Forbes Midas List over the last three years what their activity and accomplishment actually looks like in the functional areas of the job.

Besides being “busy doing great deals and distributing cash to your LPs”, what are they’re actually doing to make that happen?

The Advantage of Having Venture Backed Friends

I’ve made over 100 investments in my career and nearly half of those went into diverse teams.

I’ll be the first to back up the notion that diverse founders have just as much ambition, drive, intellectual horsepower, creativity—you name it—than anyone else. In fact, you could make the argument that, because of their lack of advantages in other areas, the ones who make it to a venture pitch actually have more of these raw ingredients because they’ve had to in order to make it to the same destination as their straight white male counterparts.

There is, however, an advantage that some founders have over others that I hate to admit exists—but one that I would very much like to solve for.

Questioning War

“Israelis & Palestinians do not deserve the consequences of evil forces that drive those who make decisions, profit from conflict, and push hateful rhetoric that make people lose their consciousness.”

This was a very powerful sentiment that I wholeheartedly embrace found in a very difficult to read (warning) Instagram post about the horror of the Hamas terrorist attack on October 7th.

This post is about considering the costs of war.

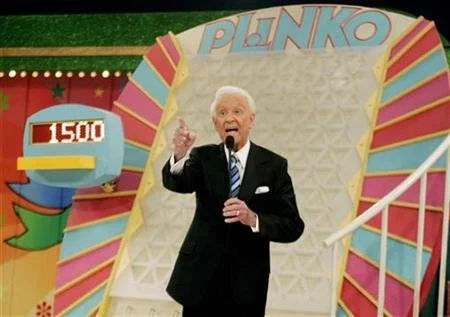

What Plinko Can Tell Us About Where to Post

What complicates the answers here is that there are some types of content that can live in multiple places (like a video) and others “types” that are so specific to a place that they’re expected to have a particular format (a TikTok video), yet they can still be transferred to other formats (a link to a TikTok video in an e-mail or placing that video on LinkedIn).

That makes trying to create a very simple-to-follow set of rules… well… not so simple. You can’t easily say that all video interviews should just go on LinkedIn because that’s the best platform or that Twitter is the best place for daily commentary on the tech world.

How to Ask for Advice and Get People to Commit the Time to Answer

When you’re asking for a one-on-one, you want the other person to feel like this is going to be a thoughtful and interesting exchange with someone who has already done a bunch of work before they’ve gotten to you. They’ve exhausted all the ways they could simply Google, Tweet, or post asks on LinkedIn for the information, and put most or all of those things into practice.

The BSList: You're Raising the Wrong Amount (No. 93)

“How much should I ask for?”

Almost every single time I talk to a founder as they’re prepping their raise, this comes up—and it’s absolutely the wrong way to think about a round.

The right question is, “How much do you need?”

The BSList: You Need a Co-Founder (No. 93)

In the case of VCs not liking solo founders, there are lots of counterexamples of successful solo founders, so it’s not like anyone has proven that you can’t win this say. There are, however, legitimate concerns that a VC might have with your team generally that the presence of co-founders might solve, but doesn’t always.

The BS List - We Don't Like This Space (No. 52)

Either VCs can identify a very specific, unassailable issue of specific risk they don’t believe the return is there for, or they’re just being lazy.

You should never let a VC off easy by letting them lazily paint a whole industry as a terrible place to invest. For everyone who’s ever said that travel sucks, music sucks, or e-commerce sucks there’s an Airbnb, Spotify, or Shein that has bucked the trend—and isn’t that what VCs are looking for? Outliers?

The BSList - Busted Cap Table (No. 104)

It is completely natural to assume that the other person loses interest in the one thing you can’t control. You’d literally have to be the lowest ego, most self-aware person in the entire world to think, “You know, objectively, I’ll bet my growth isn’t really in the top 5% of companies that this partner at a highly visible firm is seeing. I’ll bet that’s why they’ve lost interest.”

I also think the language of VC is highly confusing.

Investors say things like, “We’d be interested in writing a $500k check.”

Weirdly, what they really mean is, “If we were interested, we’d be interested in writing a $500k check.”

How to Fill Your VC Fundraising Pipeline

Everyone starts their fundraising the same way:

1) Open a shared Google Sheet.

2) List all the VCs you've ever heard of.

3) Ask a bunch of people who they know.

4) Find out very quickly this isn't very effective.

Why Don't More Emerging VCs Have Coaches?

Making sure that the next generation of investors is far more representative of the population at large than the current one is really important to me--but that won't happen unless we support the handful of folks that are already here, and do everything we can to make them successful.

This is Going to Be... Not on Substack

I realized that if I really want to maintain a relationship with my audience on my terms, I was better off doing it on my own site that I pay for—one that no one could attempt to monetize besides me.

These days, you’ll find me and my writing right back at ThisisGoingtoBeBig.com—updated with a new look and a little more information about what I’m up to. You won’t need to re-subscribe. I’ll move everyone over from Substack for my next post.

Why Most Startup Events Suck for Both Investors and Founders

The feedback from our Pre-Series A conference, our fourth in person and sixth overall, was fantastic on both sides—and while we learn new things each time we do it, I wanted to take a step back to talk about some of the event strategies and insights that underpin how we like to put these gatherings together.

The Twenty Year Itch: My Last VC Investment Out of Brooklyn Bridge Ventures

Sometime in the next few weeks, I’ll complete my next investment. It will be the 105th deal out of Brooklyn Bridge Ventures, the firm I started back in September 2012, and it will be the last deal I’ll be making out of my third fund.

It will also be my last venture capital deal.

Why AI Won't Be the Investment Opportunity Everyone Thinks It Is

The venture asset class seems to have already decided that AI is the next great investment opportunity, but I’m not so sure it’s going to disrupt business and create the across-the-board wealth that has been predicted.