Is there a right time of year to raise a seed round?

It's hard to answer that question, because even if you look at fundraising data, you don't always know a) when the round was actually closed vs. just announced or filed and b) you don't know when fundraising actually started. Maybe it was wrapped up in a week or maybe it took six months.

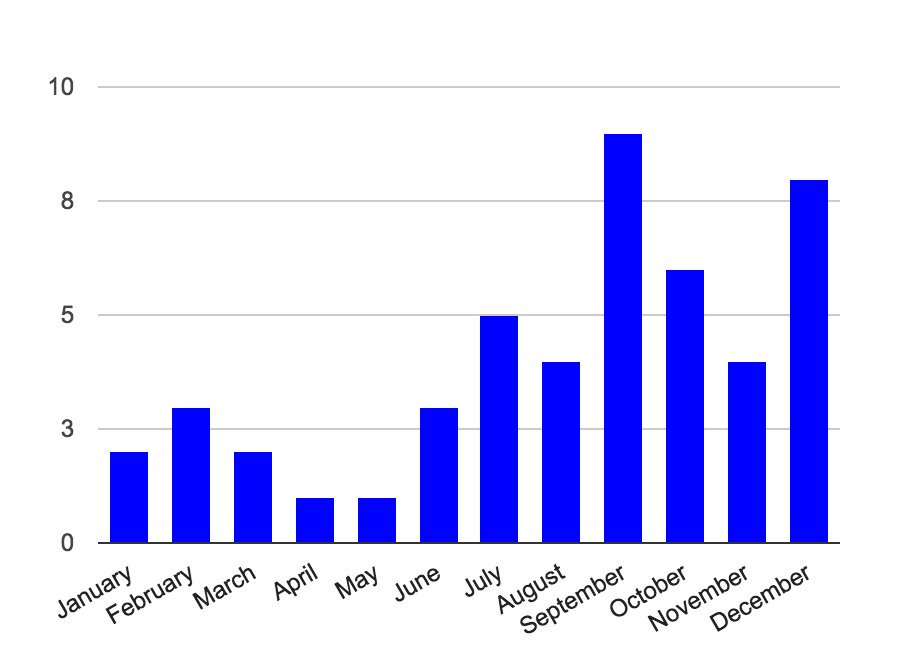

That being said, I was super curious what my own track record had to say about it. As it turns out, from 2010-2016 inclusive, 75% of my deals are done in the second half of the year.

What's the reason for that?

I have a few theories.

First, you probably don't want to have the holidays cut into your fundraising process--so most people time their raise to wrap up before the end of the year. There's a noticeable push to start raising in September to wrap things up right away. That would explain why you don't see much in January and February--because those deals were done in the 4th quarter.

What it doesn't explain is the slow second quarter. What's going on in April or May?

Well, perhaps a lot of people start new companies after the holidays--maybe after they wrap up a previous job. If that's the case, and if it takes a few months to fundraise, then you probably wouldn't see much in April. That would mean that you start fundraising almost as soon as you leave your last job--which is probably rare. You probably want to put a few months into testing the idea, recruiting an early team, etc.

This points to the idea that deals are happening because of the founder's time table--not the VC's. That I largely agree with. In fact, I think the perception of the VC timetable is largely overblown. Supposedly, all VCs go on vacation in August, but I've done as many deals in August as March, April, and May combined. A few years ago, when I was at First Round Capital, we had our largest month of the year in August. Obviously, those weren't new pitches, but it shows we were still working.

Similarly, I've found it super easy to get meetings with VCs before the holidays. While you might not get your deal closed right then and there, they're still in the office, and their calendar is probably more open than you think.

Rather than try to game the system too much for your seed round, it's best to get to know investors as early as possible, and raise whenever you need to raise.