This is not Fine: How to work in Chaotic TImes

Impact and belonging are two things in really short supply these days. Digging down deep into your reserves to do what you can for others--even when it seems like you don't have much to give, might be the biggest source of replenishment and meaning.

What could Siri do for you--if Apple ever got it right?

While we've seen massive advancement in the power of AI tools over the last year or so, we're clearly still just in the early innings of this shift. Reading through the tea leaves of Joanne Stern's interview with Apple software chief Craig Federighi and marketing head Greg Joswiak, I was actually a little hopeful.

It feels like Apple hopes Siri will evolve into a highly reliable and integrated AI companion, deeply embedded across its operating systems rather than functioning as a standalone chatbot. It's something that feels like Apple is uniquely suited to do given continued consumer loyalty to its hardware and operating system. They have unparalleled ecosystem control (iPhone, Watch, AirPods, Mac), on-device intelligence, user trust, and deep OS integration.

The Five "Ups" of Getting Early Stage VC Deal Flow

There’s no single secret to great deal flow—but the best investors treat sourcing like a craft, not a lottery. They combine consistency, curiosity, and community to ensure, not hope, that they’re seeing the best deals.

Tadpoles, Frogs and What You Need for a Series A

A lot of founders ask, “What are the metrics for a Series A?”

“You don’t earn a fundraising round as a reward for the past.”

What you’re doing is selling a ticket to the future—and the thing you’re trying to convince an investor is that you’re a) presenting a vision of the future they want to be a part of and b) you can actually execute on it.

That latter part is where we need to talk about tadpoles and frogs.

Let's Talk About Anxiety, Fear of Failure, and Why I Didn't Go to The Dentist for 27 Years

This week, I got my wisdom teeth out—all four of them.

You might be wondering what took me so long. I’m 45 and most people have them out between the ages of 17 and 25.

One helpful bit of context is that until very recently, I hadn’t been to the dentist since 1998.

Here’s what happened…

Partnership Judo: Don't work against people when vying for a partnership position

Your venture career is better off if you're working alongside the best possible people. The more of them there are that perform up to the kind of level where they have a shot at bringing in a fund-returning deal, the better it is for you.

Remember, when, at best, only about 20% of firms ever make it to a Fund III, there’s more of a chance that your path to partnership is blocked by the death of your firm than by the presence of another investor in your way.

Why Interviewing Others is Awesome for Building Your Brand

In 2015, a then 18-year-old Harry Stebbings launched The Twenty Minute VC from his bedroom in London. No background in venture capital. No industry connections. No podcasting experience. Just a cheap mic, an internet connection, and two things:

Curiosity and initiative.

Instead of waiting for the perfect job, a mentor, or an MBA to unlock those doors, he just started asking questions. Literally.

He cold-emailed VCs and invited them on his podcast.

Not to pitch them. Not to impress them. Just to learn from them.

And here’s the thing: they said yes. Not all of them, obviously—but a few. Guy Kawasaki and Brad Feld were early big names, but why did they bother?

How to Launch Your Startup Without a Launch

Gone are the days of the startup launch party. Remember those nights of trying to explain to a Techcrunch reporter why your app was going to change the world over thumping music and bad venue WiFi?

RIP.

Most startups know not to blow a bunch of money on a big party before they have their first users, but legitimate questions remain about what you do in its place—and how you open yourself up to the world that gets attention.

Founders still want to get press and investors to notice them, but they don’t have a lot of money to work with. What are they supposed to do today?

VCs Don't Owe You a Response or a Follow Up

VCs don’t owe you a goddamn thing—and especially not after they’ve already met with you. That was the time they had for you. They offered a meeting—no more and no less.

The fact that you didn’t spend the last few minutes of the meeting asking for specific feedback and posing the question of whether or not the VC was going to move this forward as a champion of the deal or at least whether they wanted to schedule a next call is your failure. When you’ve got any kind of a lead—be it for selling your product or selling your equity—and you let them go with no scheduled next step, you risk never speaking to them again.

That’s your problem, not theirs.

Fundraising is Biased and Broken. It Also Works Pretty Well and Isn't Going to Change

Everything you’ve heard about fundraising—all the worst things about it—are largely true.

Yes, straight white dudes get most of the money.

Yes, biased straight white does dole out most of the money.

Yes, many of these founders are pitching dumb stuff that gets funded all the time—especially by people they know.

Yes, someone else in the Silicon Valley insiders club got way more money than you for basically the same idea, even though you were first.

All true.

Here’s the other truth: The venture fundraising process actually does a pretty good job of distributing capital to the founders with the best chance of creating big financial outcomes.

The Nicest Place on the Internet

There aren’t a lot of places you can go online that genuinely make you feel good—and that bring out the best in you…

…especially in an election year.

That’s why when you’re in a social network for over a decade and you’ve never ever seen a negative post, gotten into an argument, or never felt worse about yourself for the time you spent on it, it really stands out.

What I Learned Coaching VCs for the Last Year and What’s Next

About a year ago, I asked why more VCs aren’t using coaches.

Given the uncertain career paths for VCs, the unique dynamics around partner promotion within and across firms, and lack of clear direction on how to best spend your time on a day to day basis, it felt like investors would benefit from talking to someone who could provide some guidance.

After all, it’s something they recommend founders do.

What followed was a stampede of newly minted associates, ambitious principals aiming for partnership positions, emerging GPs navigating their firms through fundraising, and even a few experienced partners looking to optimize their time in order to compete with up and comers.

I honestly wasn’t prepared to handle the interest—and it didn’t stop. Every week, new VCs inquired about coaching even though I had barely put it out there. I wasn’t intending on making coaching my main activity, but I found it incredibly rewarding.

I coached investors to promotions, first board seats, internal personnel decisions and even a long overdue resignation.

Here are a few key things I’ve learned...

Thinking About Proximity and Optimization in a Job Search

If you’re in venture capital and you’re trying to make partner somewhere, should you get some operational experience somewhere and then come back? It’s a question my VC coaching clients ask all the time.

Yes! 100%.

You should be like Sarah Tavel. You should source Pinterest while at Bessemer, then “[join] as a "utility player" before we had product managers, and [become] the first PM at Pinterest.”

That will lead you to ultimately become a Partner at Benchmark, one of the top venture capital firms in the entire world.

Easy peasy.

Of course, you just have to find the next Pinterest, which IPO’d for $10 billion, but that’s just a small detail.

The Tech Industry and VC Case for Kamala Harris for President

If the United States is going to continue to solve tough problems with technology, we have to have the ability to collaborate—to work together as a diverse population. That starts at the top, by example.

Kamala Harris represents the best American story we can write—the daughter of two PhD students from different cultures who came here to study. She went on to serve her fellow citizens for decades in the legal system and then in national elected office, keeping people safe and fighting for justice.

She even gets high marks from her husband’s first wife, who considers her a dedicated co-parent and a valued part of her family. This is the kind of person you would co-found a startup with—not a guy who destroys the careers of just about everyone who works alongside him.

The people who simply don’t get paid by Trump comparatively consider themselves lucky.

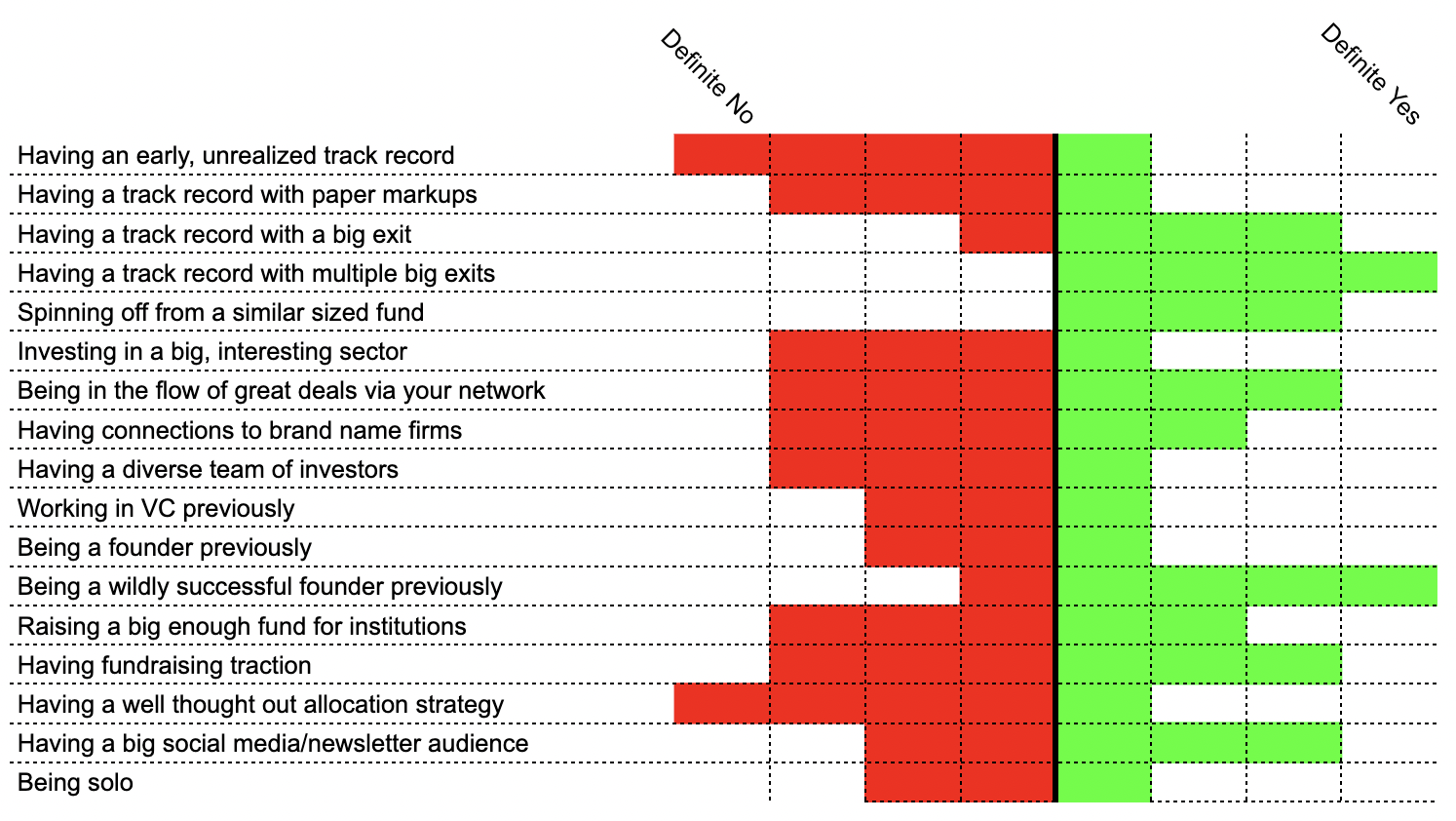

How to Objectively Measure the "Fundability" of Your Fund

Generally speaking, I think it’s easier to answer the question, “Is this manager going to be sought after to fund the best opportunities in X space/geo/etc?” than it is to try to figure out whether an individual founder will be successful with a particular startup idea. Once you’ve answered that question, you can dive into their ability to sort through their deal flow, do deal selection and the administrative functions of running a fund. Most of the criteria I listed above is all about being someone the very best and highest potential founders want on their cap table—and that’s the most important path to having great returns.

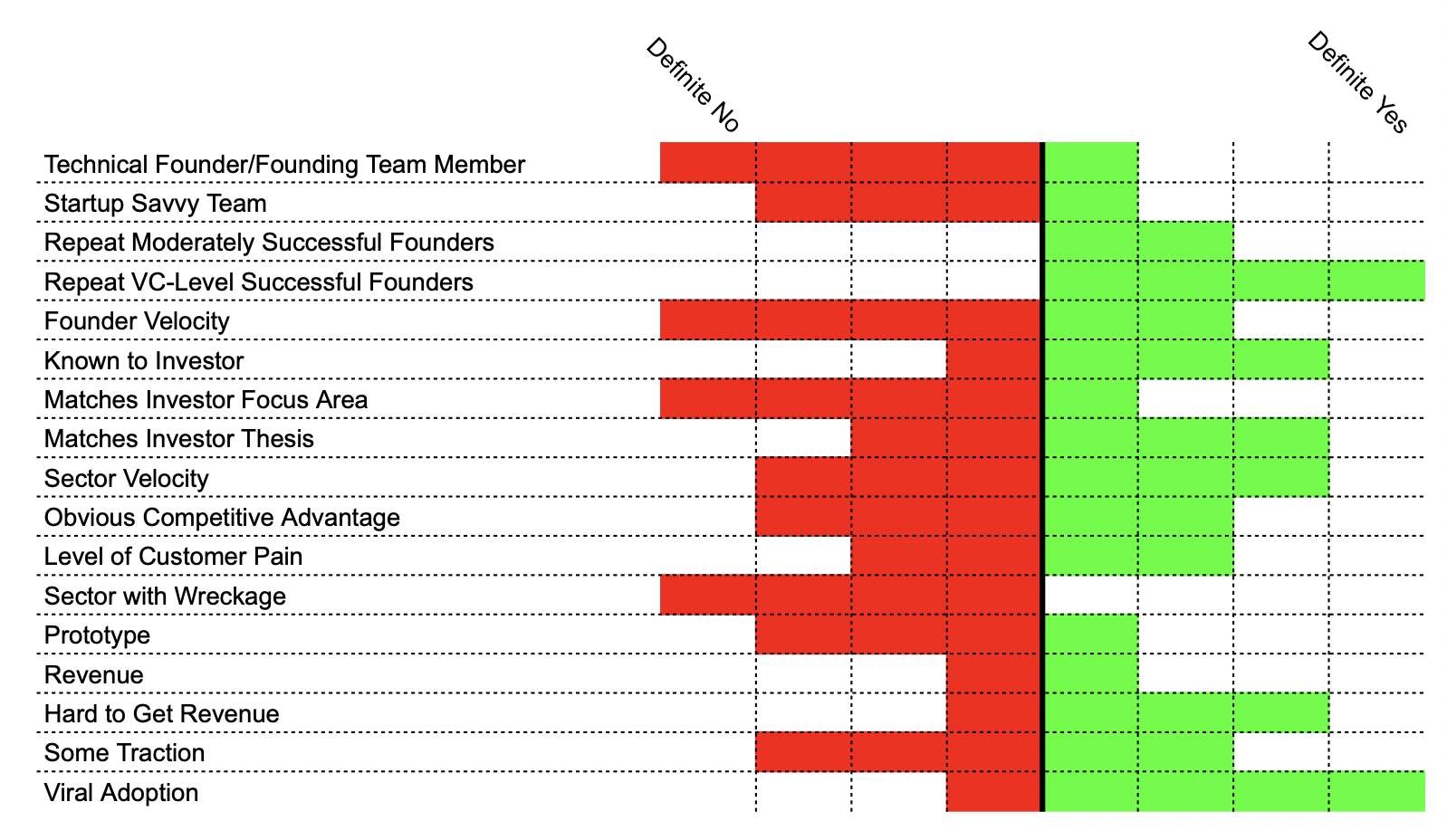

How to Objectively Measure the "Fundability" of Your Startup

The fundraising process sucks for about a million reasons—not the least of which is that investors often lack clarity and transparency in their communication. Still, there is somewhat of a method to their madness. Because feedback is usually given quickly and somewhat dismissively due to the sheer size of the average VCs funnel, founders walk away from the process feeling like VCs didn’t quite understand what they were doing, or they don’t understand the market.

This is some of the worst thinking anyone trying to make a persuasive argument can make—that if you only fully understood me, you would agree with me.

Founders need to shift their thinking to an assumption of understanding—that investors who see thousands of pitches per year probably do understand what a founder is doing the vast majority of the time, and have simply decided that the risk/reward for investing in their company simply isn’t as good of a deal as others they’re currently looking at.

That’s a hard pill to swallow—that perhaps you’re objectively not measuring up compared to other companies. This can be the case at the very same time you’re experiencing bias, microaggressions, and discrimination.

Learning When Leaving

The due diligence question I got asked most when I started was whether or not I could continue to source good deals outside of First Round Capital, where I had worked as a Principal before starting my fund. I spent a lot of time telling investors how much I didn't need that brand because it was helpful to my fundraising pitch. I wasn’t being negative—I was trumpeting my ability to be independent.

I certainly wasn't going to say, "Oh, yeah, that's going to be hard--First Round is a great brand and has a tremendous network of resources that would make me a better investor. I'm going to need to work twice as hard to piece that together independently."

How successful would that fundraising have gone?

I have no idea, because that’s not what I did.

If I had that mindset, I would certainly have become a better investor and I can see that now.

Themes vs Verticals: How to Stand Out as a VC Building a Thesis

Articulation of a focus area accomplishes a few critical things for an investor:

Inbound content marketing for deal flow—because you want your brand to get you on a founder’s list of smart people to talk to, especially if you don’t think the brand of your firm and your position within that firm will guarantee you all the best deals.

A focus and filter for networking—because otherwise, you’ll find that you could wind up in a meeting with anyone for any reason because any connection could theoretically lead to a future deal.

It signals expertise—because the best founders like talking to someone they don’t have to explain remedial things to, let alone someone who at least has an interest in what they’re doing.

The question is what to focus on.

Why Should a Founder Meet With You?

I’ve been coaching a lot of non-partner VC professionals and their number one challenge (besides taking obligatory meetings that their GP throws over the fence at the last minute—GPs, why do you do this? Stop wasting your team’s time and a founder’s time. Just pass when you think it’s a pass.) is trying to figure out how to get in front of the best founders with a title like Senior Associate or, potentially worse, Investor, which everyone assumes means Senior Associate.

Don’t get me wrong. There are very smart, likable, and helpful people in these junior roles—but compared to a partner, if you’re on the Associate level, you have no juice when it comes to getting a deal done. As a Principal, you have some juice. As a Principal at First Round, I got nine deal approvals in two years—but it was a lot more work for me than it would have been for one of the partners.

Even if your firm does allow you to lead or you were instrumental in a deal getting over the line last year, it’s actually better to act in such a way that everyone’s assumption is that you can’t lead. This way, you can challenge yourself to come up with another reason for a top founder to meet with you than as a conduit for capital.

Appropriate Accessibility: Announcing nextNYC Open Office Hours

It’s easy for a VC to just stick within your own networks and filter bubbles—and hard to scale being “open” without opening the floodgates. I sought out ways to be open for limited, manageable segments of time, because I found it valuable and inspiring.

A couple of years ago, I had the idea that I wasn’t alone in thinking this way—that if you could make it easy to for VCs to meet a bunch of folks in a finite amount of time, they’d be open to the idea knowing that some of these founders might be early in the progress. I asked a bunch of investors I knew to sign up a widely distributed Open Office Hours—across firms and across places, wherever investors wanted to meet. We had 70 investors sign up!